A BORROWER MAY USE THIS FORM ONLY IF THE BORROWER RECEIVED A PPP LOAN OF. After taking the reins in 2017 TD Bank US.

Pin On Https Businessbank Infostot Com

PPP Loan Forgiveness Under the Paycheck Protection Program PPP created by the CARES Act loans may be forgiven if borrowers use the proceeds to maintain their payrolls and pay other specified expenses.

Td bank ppp loan forgiveness. TD will email you PPP Customers with more information on how to access our digital application once it is available. PPP Loan Forgiveness For PPP loans of 150k or less the SBA has simplified the PPP loan forgiveness process. Lenders will continue accepting PPP forgiveness applications so long as borrowers have PPP loans.

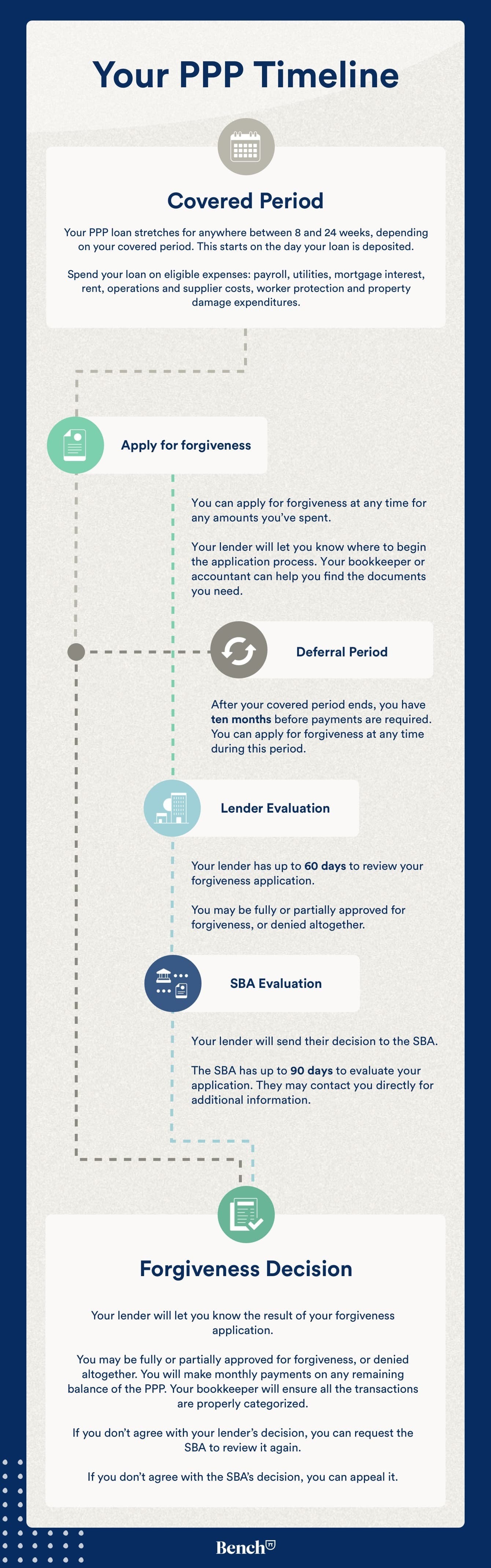

Loan forgiveness is not automatic and must be requested by the customer. However there are a few important things to consider prior to doing so. PPP loan forgiveness requirements differ depending on your businesss size and whether or not you have employees.

However the interim rule issued by the SBA on April 2 2020 provides that. In the coming weeks the SBA may make changes to the PPP forgiveness application form which. Its recommended you apply for forgiveness before you need to make your first PPP loan payment.

PPP loans will be forgiven under Section 1106 of the Act to the extent the proceeds are used to fund payroll costs interest on a covered mortgage obligation covered rent obligations or covered utilities. There is a checklist available to help you fill out your loan forgiveness application form. Updated 5-24-21 to extend expiration date.

You can download from the treasurygov website or here. Do not submit this Checklist with your SBA Form 3508EZ. PPP EZ Loan Forgiveness Application.

Employee and compensation levels are maintained The loan proceeds. PPP borrowers must apply for loan forgiveness with the lender that processed the loan. TD Bank is also building a portal that is online PPP loan TD Bank is also building an on-line portal for PPP loan forgiveness applications because it monitors developments on Capitol Hill in accordance with Andrew Bregenzer president associated with the banks metropolitan area operations.

At this time we are accepting forgiveness applications for loans of all amounts obtained in 2020. The PPP Loan Forgiveness Application Form 3508EZ is now available. It is by invite only and all customers will receive an email from TD when their turn comes up.

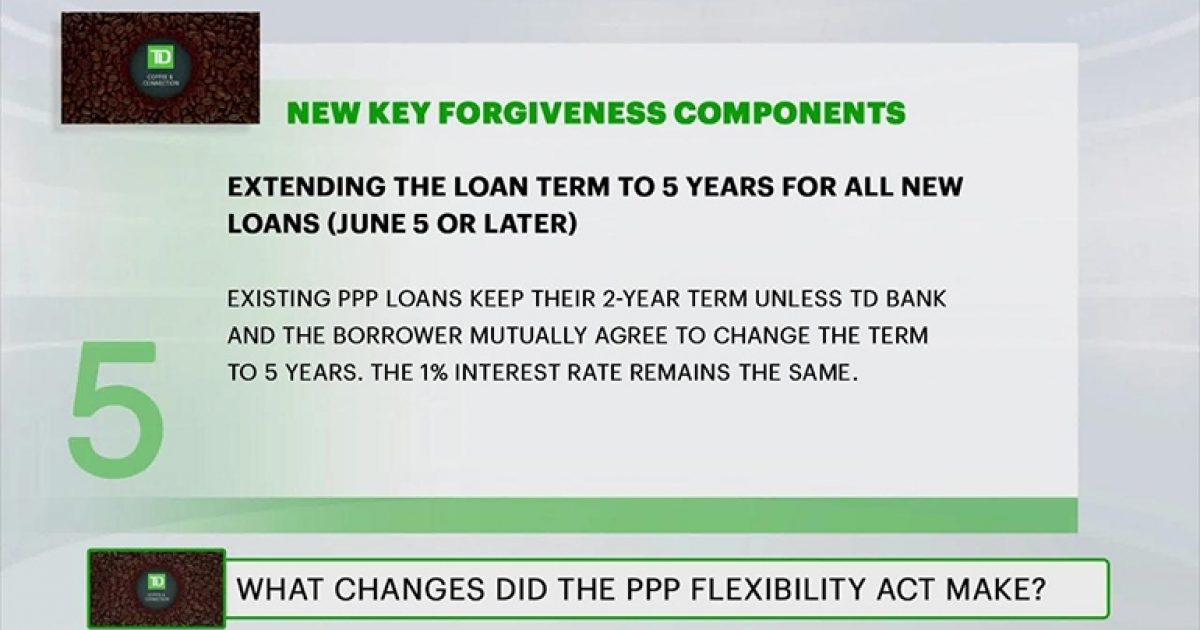

Businesses with employees might be eligible for PPP full loan forgiveness if they. The Economic Aid Act made several changes to PPP loan forgiveness including a new streamlined application for loans up to 150000. How to Apply for PPP Loan Forgiveness To make your forgiveness process as easy as possible our portal is aligned with current SBA guidelines and forms including the simplified forgiveness application for loans of 150000 or less.

First Draw PPP Loan forgiveness terms First Draw PPP loans made to eligible borrowers qualify for full loan forgiveness if during the 8- to 24-week covered period following loan disbursement. Please continue to monitor this site for updates. PPP Loan Forgiveness Calculation Form.

This EZ form is much easier theres less documentation and fewer calculations required. Also borrowers with loans greater than 150000 may be able to include additional eligible non-payroll expenses. Business Legal Name Borrower DBA or Tradename if applicable Business Address Business TIN EIN SSN Business Phone - Primary Contact E-mail Address.

TD is actively working to develop a digital forgiveness application to reflect these changes as well as anticipated additional guidance. TD is pleased to announce we are currently accepting forgiveness applications for all loan amounts. Some of the key changes to the program include.

PPP loans have a covered period of 8 to 24 weeks after the funds hit your bank account. Loan Forgiveness Application Revised June 16 2020. TD Bank will have a digital application process for PPP loan forgiveness.

No Rush On Your PPP Loan Forgiveness Application Oct 5 2020 Practice owners who received the PPP loan earlier this year had 24 weeks to spend the funds on certain payroll and facility expenses to qualify for full forgiveness of that loan. OMB Control Number 3245-0407 Expiration Date. For many of our clients the 24-week Covered Period has recently ended.

SBA PPP Loan Number. There is no deadline to apply for PPP loan forgiveness. CEO Greg Braca faced his first major crisis this year with coronavirus.

Customers with PPP loans greater than 150000 and less than 2 million can now apply through our PPP loan forgiveness portal. Maintained headcount and wages 1. In an exclusive interview he talks about PPP loan forgiveness hope for.

Used at least 60 of PPP funds on paying employees and staff and spent the rest on non-payroll PPP-eligible. You the Borrower can apply for forgiveness of your Paycheck Protection Program PPP loan using thisSBA Form 3508EZ if you can check at least one of the three boxes below.

4 Reasons Why You Should Apply For A Second Ppp Loan Smart Change Personal Finance Dailyjournalonline Com

Pin On Https Businessbank Infostot Com

Td Bank Business Covid 19 Coronavirus Ppp App Sba Loan Assistance Updates

Pin On Https Businessbank Infostot Com

Td Bank Ceo Greg Braca On Automatic Ppp Loan Forgiveness And The Critical Months Ahead Philadelphia Business Journal

What To Know About Loan Forgiveness Under The Updated Paycheck Protection Program Ppp Td Stories

What To Know About Loan Forgiveness Under The Updated Paycheck Protection Program Ppp Td Stories

When Can I Submit My Ppp Loan Forgiveness Application Bench Accounting

Video Paycheck Protection Program Ppp Forgiveness Overview Td Stories

Td Bank Ranks No 1 In Sba Lending For Fourth Straight Year In Maine To Florida Footprint

Pin On Https Businessbank Infostot Com

When Can I Submit My Ppp Loan Forgiveness Application Bench Accounting

Should Small Businesses Use Ppp Loans Revenued

Covid 19 Small Business Paycheck Protection Loan Forgiveness Landing Page