First within eight weeks of receiving the loan the proceeds must be used for payroll costs mortgage interest rent or utilities. The cases involve a range of conduct from individual business owners who have inflated their payroll expenses to obtain larger loans than they otherwise would have qualified.

Melissa Turasky a Chicago restaurateur was charged with submitting a fraudulent PPP loan application to obtain more than 175000 in a forgivable PPP loan.

Ppp loan frauds. People are starting campaigns on GoFundMe to pay back PPP loans they acquired through scams after getting caught by the Feds. Fraudulent Use of PPP Loan Funds Funds obtained under the PPP may only be used for the purposes authorized under the. On the website countless people have been seen begging people donate money to their GoFundMe so they can pay off fraudulent PPP loans and avoid going to jail.

More than 900000 companies in Florida alone applied for money from The Paycheck Protection Program known as PPP. There is a political dimension to PPP fraud. Government has good reason to believe it wasnt all legitimate.

If you suspect that someone applied for a Paycheck Protection Program PPP loan using your information. Businesses that receive funds can pursue loan forgiveness for PPP if they meet two requirements. The Justice Department has brought criminal charges against at least 209 individuals in 119 cases related to Paycheck Protection Program PPP fraud since banks and other lenders began processing loan applications on behalf of the Small Business Administration on April 3 2020.

PPP Loan Forgiveness Requirements. Any attempt to charge more than these fees is inappropriate. For example in March a Texas man pleaded guilty to a.

The Justice Department has charged more than 120 defendants with fraud related to PPP loans. Report the fraud to them. The PPP was created to help companies stay in business during the coronavirus pandemic by providing forgivable loans to cover payroll and operating expenses.

The first federal accusation of PPP loan fraud was announced by the US Department of Justice DOJ on May 5. Applying for multiple PPP loans across multiple lenders also called loan stacking 3. Paycheck Protection Program PPP fraud.

Since PPP loans are funded by wire transfers from the SBA to the individuals bank account wire fraud would likely be a result of any PPP loan fraud investigation. SBA limits the fees a broker can charge a borrower to 3 for loans 50000 or less and 2 for loans 50000 to 1000000 with an additional on amounts over 1000000 with a maximum fee of 30000. Using awarded PPP funds for unapproved purposes.

Some cases are substantial. Then go to IdentityTheftgov to report the identity theft to the Federal Trade Commission FTC and. The Government alleged that the Kwaks submitted fraudulent loan applications on behalf of several shell companies to obtain over 4 million in COVID-19 relief funds.

Common PPP Loan Fraud Triggers 1. PPP loans are loans intended as emergency relief for small business owners. Second businesses must maintain their existing levels of employee compensation.

Prominent among the departments efforts have been cases brought by the Criminal Divisions Fraud Section involving at least 120 defendants charged with PPP fraud. Again all expenditures from companies PPP loan accounts should be carefully tracked and documented. Contact the lender that issued the loan.

Using PPP loan funds to cover personal expenses and other impermissible expenditures are issues that have already come up multiple times in DOJ PPP loan fraud investigations. Paul and Michelle Kwak were charged with conspiracy to commit wire fraud wire fraud and money laundering. Two men one from Massachusetts and.

Making false statements on your PPP application 2. PPP loan fraud is when an individual or business submits false information in an application or certification for a loan under the federal Paycheck Protection Program PPP. And these cases are just the beginning.

When Can the DOJ File Charges for PPP Loan Fraud. PPP Loan Application Fraud While millions of small businesses were and remain eligible for PPP loans not all. The case was brought in Atlanta Georgia.

Mail Fraud Mail Fraud involves attempting or engaging in a scheme to defraud an individual or entity of. If you have a question about getting a SBA disaster loan call 800-659-2955 or. According to the indictment Turasky had already been evicted from the restaurant rental space and her employees had been terminated before she applied for the PPP loan.

Ppp Loan Fraud Prosecution Update May 2021 Youtube

Paycheck Protection Fraud Is Massive And Unsurprising

Pin On Interesting Infographics

New Ppp Data Indicates Evidence Possible Fraud

Snowbird Bob Pleads Guilty To Ppp Laundering In Arkansas Wire Fraud In Louisiana Wreg Com

Indian American Dinesh Sah Pleads Guilty To 24 Million Covid Relief Scheme Fraud

Payroll Protection Program Ppp Loan Fraud Rosenblum Law

Feds Arrest Entrepreneur Mukund Mohan For Ppp Fraud Diya Tv News Youtube

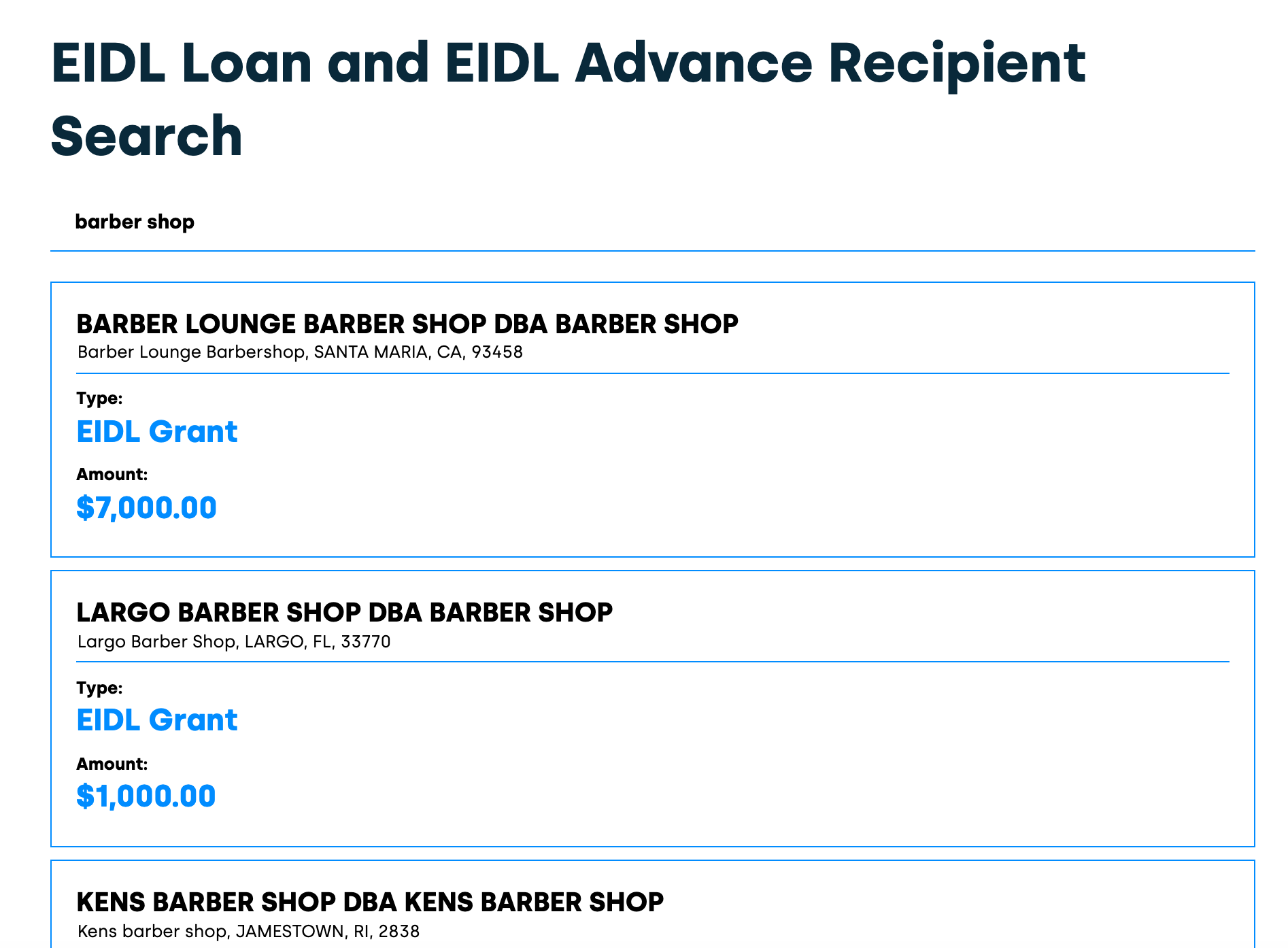

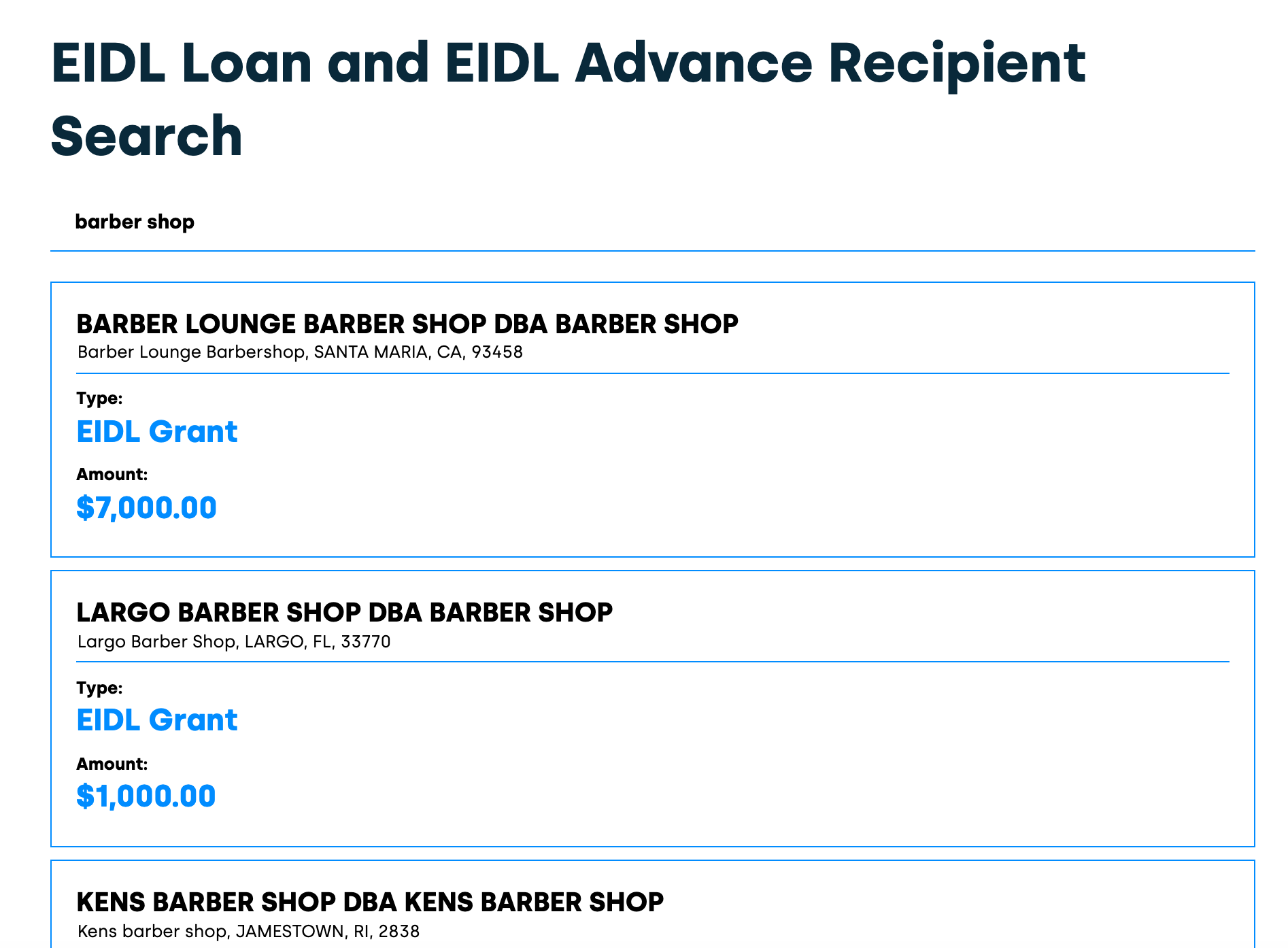

How To Check Who S Received Eidl Grants Or Loans Or Ppp Loans

Sc Charitable Group Founder Accused Of Ppp Loan Fraud Business Postandcourier Com

Mo Fayne Enters Plea In Ppp Loan Fraud Case Rolling Out

Casey Crowther Admits To Faking Bank Statements Ppp Fraud Trial Moves Forward Abc7 Southwest Florida

Ppp Loan Fraud Prosecution Update May 2021 Youtube

Ppp Loan Fraud Prosecution Update May 2021 Youtube

Alleged Dc Area Pastor Charged With Fraudulently Obtaining 1 5m Ppp Loan Fox 5 Dc Youtube

How To Check Who S Received Eidl Grants Or Loans Or Ppp Loans

How To Check Who S Received Eidl Grants Or Loans Or Ppp Loans