The loan amounts will be forgiven as long as. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

What You Need To Know To Qualify For A Second Ppp Loan Funding Circle

The SBA also announced that the PPP program officially reopens on January 11 2021.

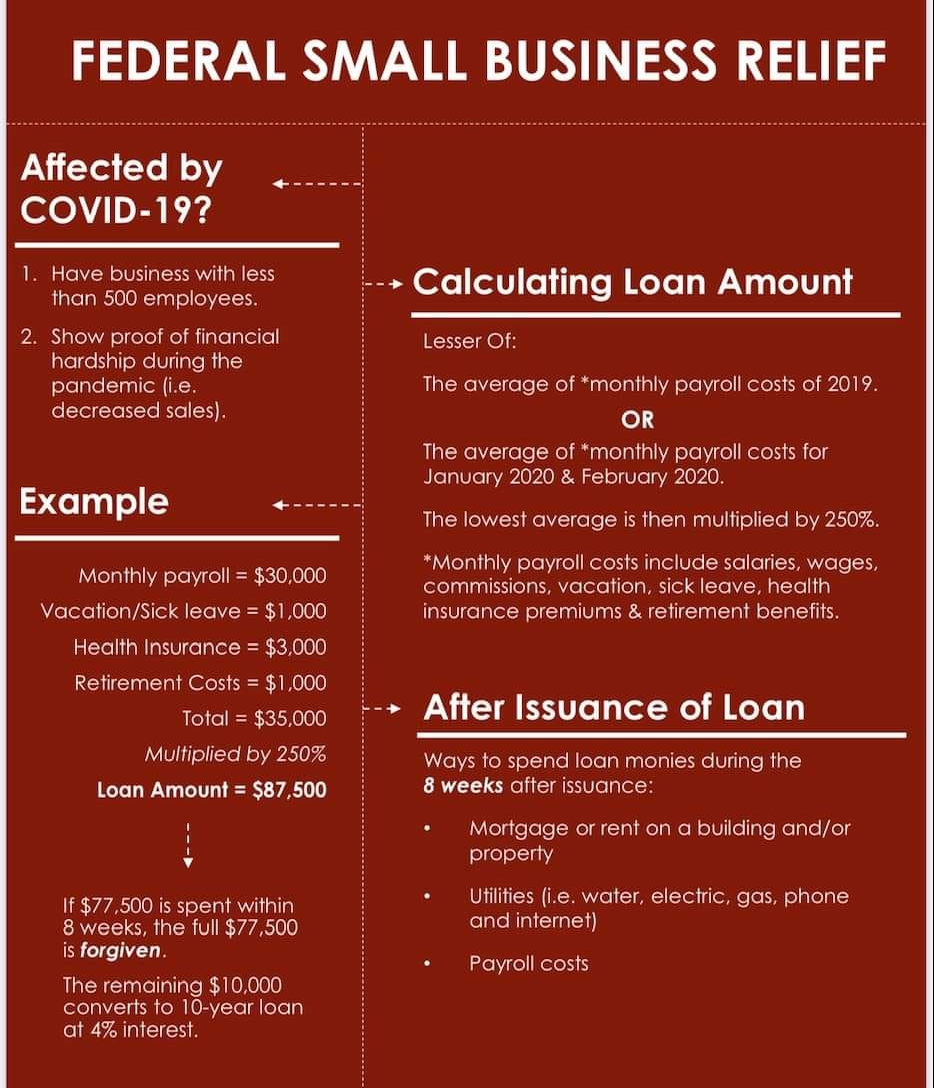

Ppp loan qualifications. Existing borrowers may be eligible for PPP loan forgiveness. First-Draw PPP loans are available for the lesser of 10 million or 25 times your average monthly payroll. First Draw PPP loans made to eligible borrowers only qualify for loan forgiveness if during the applicable covered period following loan disbursement 8-24 weeks.

PPP Loan Forgiveness. The Paycheck Protection Program PPP ended on May 31 2021. For loan amounts under 150000 the 25 reduction needs to be proven during the forgiveness process.

This new second PPP loan means new eligibility requirements. 1 employee and compensation levels are maintained. An SBA-backed loan that helps businesses keep their workforce employed during the COVID-19 crisis.

Find out if your business is eligible for a PPP Loan and where you can apply once applications are open as early as Monday January 11th. Details on the size standards and exceptions are on the SBA website. An important factor to consider when applying for the PPP Loan is that your business must be in Good Standing.

All loan terms will be the same for everyone. Everything You Need to know. Initially loan applications will only.

The Paycheck Protection Program PPP authorizes up to 349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis. Maximum loan amount and increased assistance for accommodation and food services businesses. PPP Loans under Cares Act rules change incl certification economic uncertainty makes PPP loan request necessary to support ongoing operations and borrowers cant access sources of.

You were in operation as of February 15 2020 You are an independent contractor sole proprietor or other qualifying business classification with self-employment income. To apply a business must have used up their first PPP loan have no more than 300 employees and show a 25 reduction in revenue from 2019 to 2020. For most borrowers the maximum loan amount of a Second Draw PPP loan is 25x the average monthly 2019 or 2020 payroll costs up to 2 million.

Applying For The PPP Loan For The First Time. What Are the Requirements for Applying. Any borrower that together with its affiliates received PPP loans with an original principal amount of less than 2 million will be deemed to have made the required certification concerning the necessity of the loan request in good.

If youre applying for a PPP loan for the first time heres what you need to know. Restaurants and hospitality businesses may qualify if they have 500 or fewer employees per location. And 3 the remaining loan proceeds are spent on payroll costs or other eligible expenses.

2 at least 60 percent of the proceeds are spent on payroll costs. In this presentation well review the guidance from the SBA explain the qualifications for the Paycheck Protection Program PPP Loans and help you get ready to apply. Last week the SBA released new guidance related to the availability of and eligibility for additional funds available under the Paycheck Protection Program PPP.

The loan proceeds are used to cover payroll costs and most mortgage interest rent and. Second-Draw loans up to 2 million are available for. Key Details Loan Eligibility Requirements.

The PPP loan program was established by the SBA and as such it is necessary to find a bank who is a recognized 7a lender. To qualify your business must have been in operation since at least February 15 2020. For borrowers in the Accommodation and Food Services sector use NAICS 72 to confirm the maximum loan amount for.

To qualify for a PPP loan self-employed individuals must meet the following criteria. SBA in consultation with the Department of the Treasury has determined that the following safe harbor will apply to SBAs review of PPP loans with respect to this issue. You also have to.

Get a clear picture of what is required and how to later submit your forgiveness application to your lender. In order to have your loan forgiven you must follow the rules of the Paycheck Protection Program and use the funds for set purposes. The bottom line is that the loan was meant for smaller companies of between 1 and 500 employees who were suffering loss of income and revenue because of the virus.

PPP Lenders Accepting Loan Forgiveness Applications in 2021.

Understanding Ppp Loan Forgiveness Application And Instructions

Ppp Second Draw Eligibility How To Apply In February 2021 Funding Circle

Does Your Organization Qualify For A Second Draw Ppp Loan

How To Calculate Your Ppp Loan Amount Bluevine

Ppp Loans For Partnerships What You Need To Know Bench Accounting

Small Business Paycheck Protection Program Medical Billing And Coding Small Business Small Business Administration

How To Apply For Paycheck Protection Plan Ppp Loan Forgiveness First Palmetto Bank

A Review Of The Paycheck Protection Program Ppp 1 And 2

New Paycheck Protection Program Ppp Loans How To Qualify And Apply Nav

How The Upcoming Round Of The Paycheck Protection Program Ppp Works

Best Ppp Lenders To Apply With Step By Step Guide To Applying In 5 Minutes Youtube

Everything You Need To Know About Ppp Loans In 2021 Funding Circle

Sba Ppp Guidelines For Sole Proprietors And Independent Contractors

Top Ppp Loan Lenders Updated Approved Banks Providers

Ppp For Self Employed How To Calculate Ppp Loan Amount Using Gross Income Youtube