Upgrade loan company reviews are a good way to explore the companys rates terms and fees. In addition to the interest.

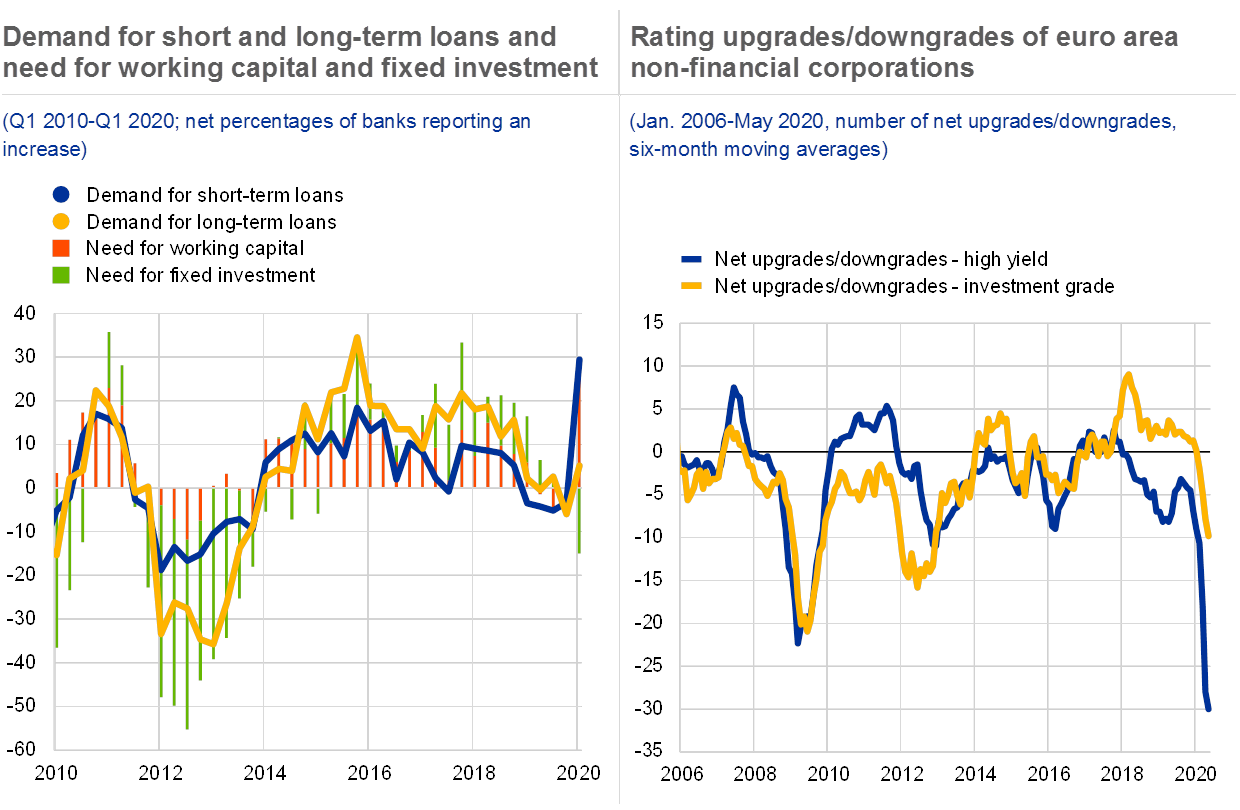

Financial Stability Review May 2020

It reviews your credit profile and focuses on what you make vs.

Upgrade loan reviews. I recommend you do business with Upgrade. When applying for loans its important to factor in the number of fees you would have to pay. A relatively new entrant into the personal loan space Upgrade offers unsecured personal loans up to 50000 with annual percentage rates APRs that range from 694 to 3597.

29 to 8 of the loan amount taken out of the loan funds before theyre disbursed. All you have to do is compare your deals and make your pick. Upgrade offers fixed-rate personal loans of up to 50000 to borrowers with fair credit or better.

An Upgrade personal loan comes with fees. Upgrade does not disclose a minimum credit score to be approved for a personal loan. One downside to Upgrade is that the lender charges origination fees ranging from 29 to 8 on every single loan.

A number of the negative comments are from people whose loan applications was denied. Upgrade notes that four fees maybepossible. Once you make your selection the lender then transfers the loan to your bank account directly.

While its frustrating to go through the application process only to be told no theres no financial institution in the world that approves all loan. This fee is higher than competitor origination fees. That was excellent service.

Upgrade Loan Review. They also gave me a line of credit. The company also has.

If you can qualify for the best terms Upgrade offers low interest rates and origination fees. The Upgrade loan reviews are positive the company is rated A by BBB and has a wide network of lenders. My credit score had recently jumped 70 points and Upgrade gave me a 2000 signature loan in around 15 minutes and the funds in my checking account the next business day.

Their customer-focused systems make Upgrade an easy option when youre in need of a personal loan. The application process is entirely online and applicants can get approved and receive their. Of the 240 Upgrade loan reviews 86 percent of customers gave the company 5 stars.

Since many fees are percentage-based the more you borrow the higher your potential charges. But other lenders may offer you a similar loan amount and terms with no fee. Upgrade charges a one-time origination fee which is deducted from.

The typical personal loan provider asks for a credit score of around 660 but Upgrades minimum credit score is reportedly. Upgrades personal loan offerings are somewhat of a mixed bag. The rates are fixed so will not vary over the course of the loan.

Upgrade is a good loan company for those who prefer simplicity and flexibility. 2021 Review Upgrades personal loan stands out for its many consumer-friendly features and unique underwriting principles. Read our detailed Upgrade personal loans review to learn about the interest rates terms fees loan amounts and more offered by Upgrade.

Many customers highlight good experiences with customer service in addition to a fast loan application and equally fast processing and transfer of funds. As weve stated in this Upgrade review APRs range from a very reasonable 698 to a much steeper 3589. Upgrade is an online personal loan provider that offers loans ranging from 1000 to 35000 to be repaid in either 36 or 60 months.

Upgrade offers loans up to 35000 which is more than some competitors. Upgrade Personal Loans. The biggest benefit of a loan from Upgrade is that it should be a lot easier to get than a loan from many competitors.

However Upgrade personal loans may not provide the best option for borrowers with bad credit or excellent credit. People who made positive comments about Upgrade Personal Loans describe an easy quick loan application process and professional courteous customer service. This variation can make a significant difference in how affordable the loan is for the borrower.

Upgrade Personal Loan Fees. Usually loan application processing takes about three to five business days of review time. Upgrade offers personal loans ranging from 1000 to 50000 in all states except Colorado Iowa Maryland Vermont and West Virginia.

When it comes to Upgrade loans expect to receive funds within four business days once your loan application has been approved. If you have fair to good credit Upgrade loans may be the best option available. There is also no exact.

If you have bad credit you could be hit with rates of up to 3599. With Upgrade you can apply for a loan fast and get the best deals in the shortest time. It may make more sense to work with a lender that doesnt charge origination fees particularly if you have excellent credit.

While a minimum credit score of only 620 is needed to qualify we think Upgrade is a better fit for borrowers with credit scores of 680 and above. Annie Millerbernd Nov 12 2020 Many or.

Upgrade Personal Loans 2021 Review Nerdwallet

Upgrade Credit Card Learn How Can I Upgrade My Credit Card

Upgrade Card Review A Good Choice For Low Interest Financing Creditcards Com

/images/2019/11/14/upgrade_personal_loan_review.jpg)

Upgrade Personal Loan Review 2021 Pre Approval In Minutes Funding In A Day Financebuzz

Www Savewithupgrade Com How To Apply Upgrade Personal Loan Online Personal Loans Online Personal Loans Apply For A Loan

Upgrade Reviews Online Personal Loans And Cards

/upgrade-inv-7d8c6d8780394521a13ee731cd011a3e.png)

Upgrade Personal Loans Review 2021

Upgrade Personal Loans Review For 2021 Lendedu

Upgrade Personal Loan Review Best For Applicants With Good To Excellent Credit Valuepenguin

Upgrade Personal Loans Review July 2021 Credible

Upgrade Card Reviews July 2021 Credit Karma

How Can I Contact Upgrade Upgrade

Debt Consolidation Loans Upgrade

Upgrade Personal Loan Review Best For Applicants With Good To Excellent Credit Valuepenguin

Upgrade Reviews Info Personal Loans Up To 35 000