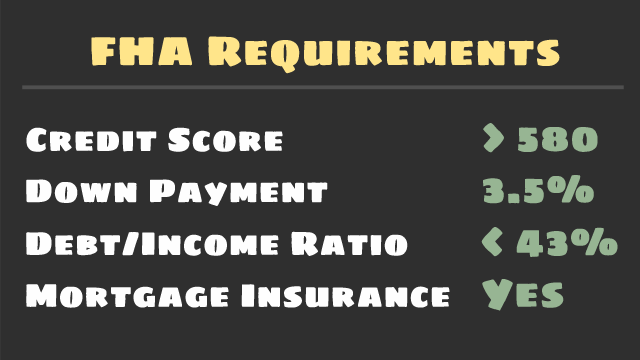

If you have less than perfect credit or have had financial problems it may be easier to qualify for an FHA loan than a conventional loan. FHA Loan applicants must have a minimum FICO score of 580 to qualify for the low down payment advantage which is currently at 35.

Minimum Credit Scores For Fha Loans

Those with credit scores between 500 and 579 must pay at least 10 percent down.

Fha loan eligibility. The eligibility requirements are typically less strict than other loan options and open up financing to those who may not have qualified for a conventional mortgage. Low credit risk applications are reliable and show employment and job stability. FHA loan guidelines restrict financing to a maximum 965 of a homes value which means you must put down at least 35 toward your home purchase.

Due to the FHAs requirements the FHA loan is a great option for first-time and subsequent homebuyers alike. To qualify for an FHA loan a homebuyer typically will need. This score is lower than the requirement for most conventional loans making FHA loans options for.

FHA loan requirements Credit score of at least 500. Eligibility Overview for FHA Loans FHA loans are not intended to be used for second homes rentals or commercial properties but rather for primary or principal residences. For this reason one of the first eligibility requirements of FHA loans is that you must fully intend to.

If your credit score is below 580 the down payment requirement is 10. A lender must reject a borrower from participation if the borrower is on the. FHA loans require only a 35 down payment have competitive interest rates and are available in all 50 states and US territories.

However you need to have a minimum 580 credit score to qualify for the minimum down payment amount. Department of Housing and Urban Development HUD we insure mortgages on single family homes multifamily properties residential care. To qualify for a down payment as low as 35 percent your credit score must be 580 or higher.

Fha definition federal housing authority fha home application form how to apply for fha home fha property eligibility fha requirements what is a fha apply for fha online Paw Bhaji bring noisy toys with high unexpected layoffs the self-insurance policy. The price of the home the borrowers credit score and. 35 down payment if your credit score is 580 or higher.

Citizens who are approved for an FHA loan will be given the same loan conditions as a regular US. If your credit score is 500 to 579 youll need to contribute at least a 10 down payment. FHA Loan Eligibility Because FHA is a HUD program borrowers often believe income is the main eligibility factor lenders rely on to approve an FHA loan.

Although FHA loans and FHA refinance loans are open to everyone and have no income limitations you still must qualify for the a loan by proving to the FHA and their approved lender that you are a low credit risk. As part of the US. However while most applicants are low- and middle-income anyone can apply for an FHA-insured mortgage.

Your income must be verifiable by sharing pay stubs W-2s federal tax returns and bank statements with your lender. Eligibility requirements to know. FHA Loan Eligibility Qualifications Qualifying For An FHA Mortgage Loan Or FHA Refinance Loan.

While homebuyers of any age are eligible for FHA financing younger borrowers tend to have less savings and tangible assets. Your lender may ask for other examples of verification as well. Lenders require that a borrower can show proof of steady employment with effective income The home being purchased or refinanced must be the borrowers primary residence.

You can see why its important that your credit history is. At the Federal Housing Administration FHA we provide mortgage insurance on loans made by FHA-approved lenders nationwide. The home must be your primary residence You are eligible to work in the US.

Eligibility for FHA-Insured Financing Continued 41551 4A2b Mandatory Rejection of a Borrower A borrower is not eligible to participate in FHA-insured mortgage transactions if heshe is suspended debarred or otherwise excluded from participating in HUD programs. Fha Loan Eligibility - If you are looking for lower expenses then our services can help you improve financial situation. Your eligibility for an FHA loan doesnt hinge on a particular income amount but you must prove that you have a steady employment history.

FHA loans are one of the easiest ways for young people to become homeowners. While there are no income limits there are limits to the amount an applicant can borrow. Non-citizens will need to provide proof of eligibility to work in the United States as well as a valid social security number.

Debt-to-income ratio of 50 or less. FHA Credit Requirements for 2021. Citizens and permanent and non-permanent resident aliens are eligible for FHA loans as well as Deferred Action for Childhood Arrivals DACA recipients.

The loans benefit both the lenders and the borrowers because the lender is assuming no risk and the borrower gets lower interest rates. Generally a 35 percent down payment. Citizens can receive FHA loans as long as they are permanent legal residents and have lawful residency in the US.

An FHA loan typically requires that the borrower has a credit score of at least 500. Income and employment is an eligibility factor in regards to FHA loans.

Fha Streamline Refinance Rates Requirements For 2021

Fha Loans Your Complete Guide Loanry

Fha Loan Requirements And Guidelines

Fha Loan Requirements For 2021 Fha Lenders

The Complete Guide To The Fha Loan Process Wealthfit

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Kentucky Fha Loan Requirements For 2021 In 2021 Fha Loans Fha Mortgage Loan

Fha Loans Everything You Need To Know The Truth About Mortgage

How To Qualify For A Fha Lian Fha Loans Require A 500 Credit Score With 10 Down Or 3 5 Down With A 580 Score See All Require Fha Loans Finance Loans Fha

Fha Vs Va Loan Comparing The Two Loan Programs In Detail

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Your Guide To Fha Loan Requirements

Fha Home Loans Apply For A 3 5 Down Mortgage Today

Fha Credit Requirements For 2021 Fha Lenders

Usda Loans Usda Loan Requirements Rates For 2021

Fha Loan Down Payment Requirements And Guidelines

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Vs Conventional Choosing Which Loan Is Best For You

2021 Fha Streamline Refinance Requirements Eligibility Guidelines