USDA provides opportunities to individuals and communities. There is no minimum credit requirement for the USDA loan.

Usda Loans How Do They Work Usda Loan Loan Usda

Talk with a home mortgage consultant about loan amount type of loan property type income first-time homebuyer and homebuyer education requirements to ensure eligibility.

Usda loan requirements. Rural Development however does not guarantee the accuracy or completeness of any information product process or determination provided by this system. This site is used to evaluate the likelihood that a potential applicant would be eligible for program assistance. First the home must be in a qualified rural area which USDA typically defines as a population of less than.

In order to be eligible for many USDA loans household income must meet certain guidelines. Department of Agriculture backs USDA loans in the same way the Department of Veterans Affairs backs VA loans for veterans and their families. HB-2-3550 Direct Single Family Housing Loans and Grants - Customer Service Center Handbook.

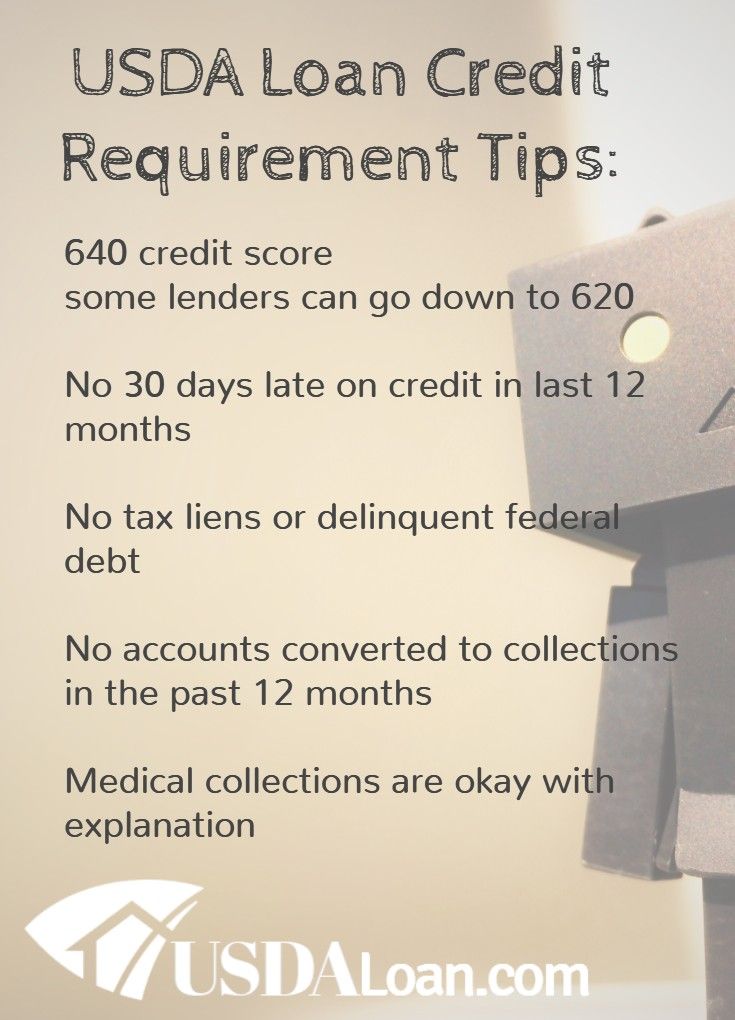

Minimum credit score 640 with most lenders. It addresses the requirements of section 502 h of the Housing Act of 1949 as amended and includes policies regarding originating servicing holding and liquidating SFHGLP loans. Borrowers with a credit score as low as 500 may qualify with a 10 down payment and need a 580 credit score with just 35 down.

USDA Loan Property Condition Requirements. USDA loan requirements. Learn how to prepare recover and help build long-term resilience.

If you have confusions you can take help from the Federal Home Loan Centres Counsellors to determine whether the property is. USDA loans are mortgage loans that help make purchasing a home more affordable for those living in rural areas. This government backing means compared to conventional loans mortgage lenders can offer lower interest rates.

Also the home to be purchased must be located in an eligible rural area as. Welcome to the USDA Income and Property Eligibility Site. This mortgage type reduces costs for homebuyers in eligible rural and suburban areas.

FHA Loans Key Differences. However borrowers must demonstrate compensating factors to Rural Development in order to be eligible for the 21 temporary buydown option as defined in Rural Development Instruction 1980345c5 Determining regular payment amounts. USDA loans require no down payment unlike FHA and conventional loans.

In addition to a property falling within the confines of what is considered modest housing a home must also meet strict quality assurance guidelines. To qualify for a USDA loan the requirements are as follows. More USDA vs.

Every effort is made to provide accurate and complete information regarding eligible and ineligible areas on this website based on Rural Development rural area requirements. Do not have to be employed in the agricultural industry even though the Department of Agriculture backs the loans. USDA Loan Credit Requirements.

For eligible customers options like FHA VA and the Guaranteed Rural Housing programs may. Do not have to be a first-time homebuyer. USDA Loan does not have any specific credit requirements in order to use the 21 temporary buydown.

Government mortgage loan options. Basic USDA loan requirements include. However applicants with a credit score of 640 or higher are eligible for the USDAs automated underwriting system.

The condition of the property you want to finance with a USDA loan must meet certain requirements. Escrow Taxes and Insurance. It is one of the most cost-effective home buying programs in the marketplace today.

The USDA monthly guarantee fee is lower than FHA monthly mortgage insurance in most cases and you may be able to roll these fees into your loan. Applicants must show stable and dependent income and a credit history that demonstrates the ability and willingness to repay the loan. 7 CFR Part 3555 - This part sets forth policies for the Single-Family Housing Guaranteed Loan Program SFHGLP administered by USDA Rural Development.

The United States Department of Agriculture USDA sets lending guidelines for the program which is why it is also called the USDA Rural Development RD Loan. Must be a US. You may be able to roll your closing costs into your loan.

The property to be financed should be located in one of the USDA designated rural areas. Our thoughts are with local communities and our employees who are facing unprecedented devastation. To qualify for a USDA loan you.

Credit scores FHA loans have the lowest credit requirements of any mortgage loan. USDA home loan qualifications and requirements. USDA eligibility is based on the buyer and the property.

You can qualify with a credit score as low as 640. Offer low down payment programs. Clean credit history No late payments or recent bankruptcy or foreclosure.

Acceptable Income And Job History For A Mortgage Loan Approval In Kentucky Real Estate Infographic Buying First Home Real Estate Quotes

Kentucky Rural Housing Usda Loans Usda Loan Conventional Loan Fha

How To Qualify For A Usda Home Loan Home Loans Best Homeowners Insurance Mortgage Marketing

Usda Mortgage Insurance Premium Mortgage Loans Usda Loan Usda

Kentucky Usda Rural Housing Loans Kentucky Usda Rural Development Loans Program Guid Rural Development Loan Refinance Loans Home Loans

Pin On 100 Down Kentucky Fha Mortgage

Understanding Mortgages Understanding Mortgages Usda Loan Mortgage

Kentucky Rural Housing Development Mortgage Guide For 2021 Usda Loans Kentucky Usda Mortgage Lender For Rural Housing Loans In 2021 Usda Loan Mortgage Kentucky

Usda Home Loan Program Highlights Usda Loan Mortgage Loan Originator Home Loans

Kentucky Usda Rural Development Loans Rural Development Loan Rural Kentucky

What Are The Kentucky Fha Credit Score Requirements For 2020 Mortgage Loan Approvals Kentucky Fha Mortgage Loans Guidelines Fha Loans Mortgage Loans Fha

Tumblr Usda Loan Home Loans Usda

A Href Https Www Mortgagecalculator Org Helpful Advice Types Of Mortgages Php Epik Dj0yjnu9afdmztrplu14atn2vwhfu In 2021 Understanding Mortgages Usda Loan Mortgage

What Is A Usda Loan Eligibility Rates Advantages For 2018 Usda Loan Usda Loan Requirements Loan

Usda Loans Info Usda Loan Usda Home Buying Checklist

Usda Better Program Vs Fha First Time Home Buyers First Home Buyer Home Buying Process

Pin On Usda Home Loan Education

Request Your Free Report The Usda Blueprint For Success Usda Loan Fha Loans Home Improvement Loans